Q&A: A narrative approach to climate scenario analysis at USS

Climate scenario analysis is a way for organizations to consider the potential impacts of climate change on their business. It is an essential tool in helping organizations plan their strategy and business activities as they seek to minimize their risks and pursue their opportunities under different warming scenarios. Given the complexities involved and the high level of inherent uncertainty in the climate transition, preparing a scenario analysis is not a simple process.

Universities Superannuation Scheme (USS), the largest private pension scheme in the UK, has developed – in collaboration with the University of Exeter – a relatively new approach that puts narrative scenarios at the centre of its climate scenario analysis. USS sees climate change as a significant financial risk and therefore has an ambition for their investments to be Net Zero by 2050, if not before.

We spoke with Mirko Cardinale, Head of Investment Strategy, to find out more about USS’s narrative-focused approach and how it is helping to shape investment strategy and decision making.

Q. Why do you think climate scenarios are important in the investment decision-making process?

A. The climate transition will affect the evolution of economies and financial markets over the next 10 to 20 years, so climate scenario analysis is a very important tool as we think about asset allocation and investment strategy. Climate change will have financial ramifications across the investments and geographies that a pension fund with a global footprint will invest in, so it really is important to understand in detail how it might play out. You could argue that climate risk is slow moving, but some of the decisions that have to be taken to prevent the most catastrophic effects of climate change need to be taken in the next few years, otherwise tipping points will be reached that we cannot reverse.

Q. What has driven you to establish a new climate scenario approach?

A. It started with a general dissatisfaction with existing approaches to scenario analysis.

The focus on temperature pathways as a guide to establish different scenarios forces you to make assumptions on very long-run developments, which is hard to do. If you’re trying to model to 2050, there are many assumptions you need to make about the sequence of events and how they might play out. The focus on long-term scenarios is probably detrimental to getting a clear understanding of the impact of climate and how it interacts with macro and financial variables, both in the short and long term.

We also found that existing approaches used very simplified assumptions. There is a very simple chain – going from an assumption on a pathway and temperature change to the GDP impact, and then what the impact of that might be for financial markets and other variables. By simplifying the problem this way, you lose many of the nuances, which in themselves can have a significant impact.

So that was a driver for us to explore a different approach.

Q. How is the approach you’ve taken different?

A. We decided to focus on a shorter horizon. Over a short horizon we can understand the potential sequence of events and we can understand better the interaction between climate transition considerations and other macro drivers. We focused on 2030, which is a milestone for most institutions’ transition planning and carbon reduction targets. It is also an important milestone because by 2030 we will know if the world is on the right path towards net zero or not.

The other thing we’ve done differently is, rather than starting with a model that uses simplified assumptions and then derives some very precise estimates on the back of that, we started with narratives.

A narrative helps you understand the interaction between the different factors – you’re bringing in experts across different fields and, rather than just looking at climate in isolation or the economy in isolation, you look at how everything interacts. How the climate transition interacts with macroeconomic developments, the priorities of policy makers, geopolitical developments and technological developments.

Q. Can you give us an example of one of those narratives? How does it work?

A. We started from a very high-level view of how the climate transition could play out and the dimensions we would need to consider when thinking about the climate transition in the next five to ten years.

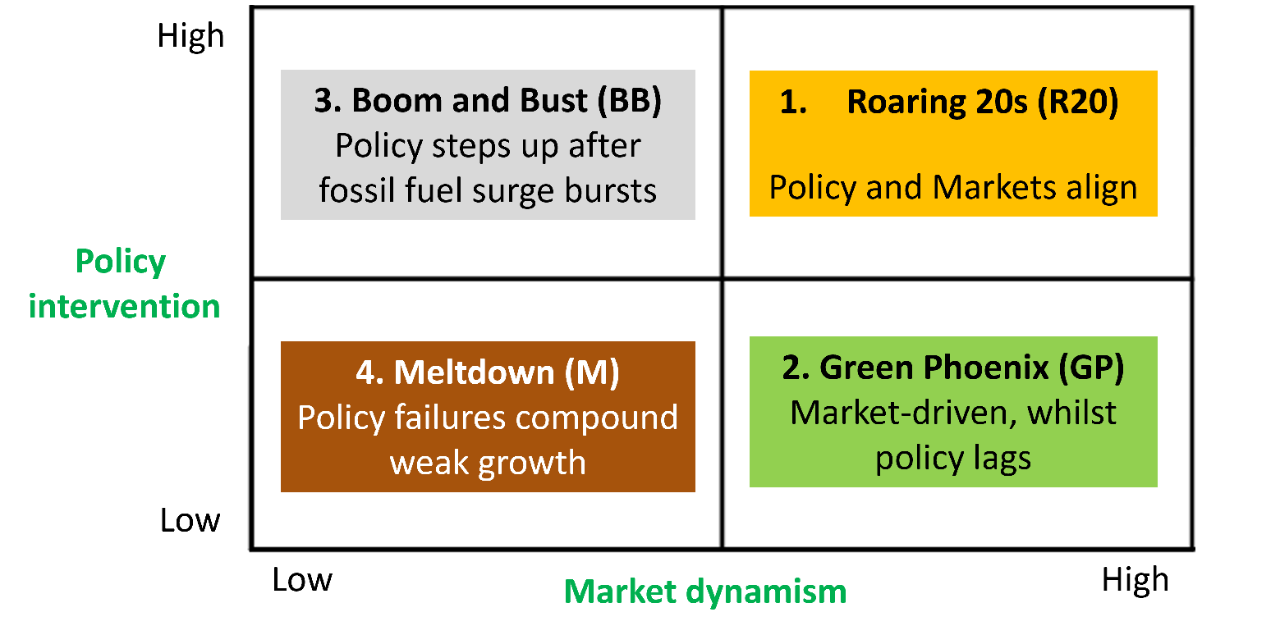

We then defined a 2x2 matrix that gave us a framework that then could be enriched by the narrative. We looked at two main factors:

- Policy coordination – the degree to which policies at the national level and across nations are coordinated to tackle the climate challenge.

- Technological developments – the extent to which technologies and the private sector provides solutions that can compete with fossil fuels so we are able to speed up the transition, even potentially in the absence of policy coordination.

These dimensions represent the different possible outcomes for how the climate transition will play out. Then you can create scenarios, picking from this 2x2 matrix.

Image: Mark Cliffe, RWCS, quoted in 'No Time To Lose', University of Exeter/USS September 2023

For instance, you could look at a scenario in which policy coordination is not very good but at the same time you have very quick technological development as companies prioritize the search for new technology. So you could get what we have called a ‘green phoenix scenario’ – a world where the transition happens because of the speed of technological developments rather than because of strong policy coordination.

There is also the possibility that technology doesn’t really come to the rescue and is not able to deliver effectively in the face of the challenge. If you take that view, that would take you into the ‘meltdown scenario’, which assumes that the private sector doesn’t come to the rescue, the policy coordination’s not there, and it’s very difficult to make progress with the climate transition and reducing emissions.

Our next step is to understand in more detail the implications for key economic and financial variables. Rather than excessive quantification, we try to define plausible ranges for the main variables. Then, are there any particular regional preferences or geographical dimensions that need to be factored in? Some regions are energy producers and others are energy importers, so if you make assumptions about fossil fuels and renewables you will have different outcomes for different regions.

Then the next level down is understanding how different sectors might behave in different scenarios. That’s an area we’re still looking to develop further. We would like to build a sector heat map to really help us understand risks and opportunities across the scenarios to help us really fine-tune our strategy.

Q. How does the quantitative side come into this?

A. We can use plausible ranges derived from scenarios for key variables, such as real interest rates and inflation, to compare outcomes across different portfolios.

For strategic asset allocation, we start with a quantitative filtering approach – we have some basic requirements and constraints, so we filter out portfolios that wouldn’t meet these. Once we have a smaller set of portfolios, then we can use a mixture of qualitative and quantitative analysis to rank them. We use a quality assessment framework. For each candidate portfolio – by ‘candidate portfolio’ I mean each different potential strategic asset allocation at this stage – we will look at some quantitative statistics, like more traditional expected returns or downside risk. But we also look at scenario resilience – whether the portfolio will be more resilient to particular scenarios.

Q. Can you lay out the different stages of your narrative scenario approach?

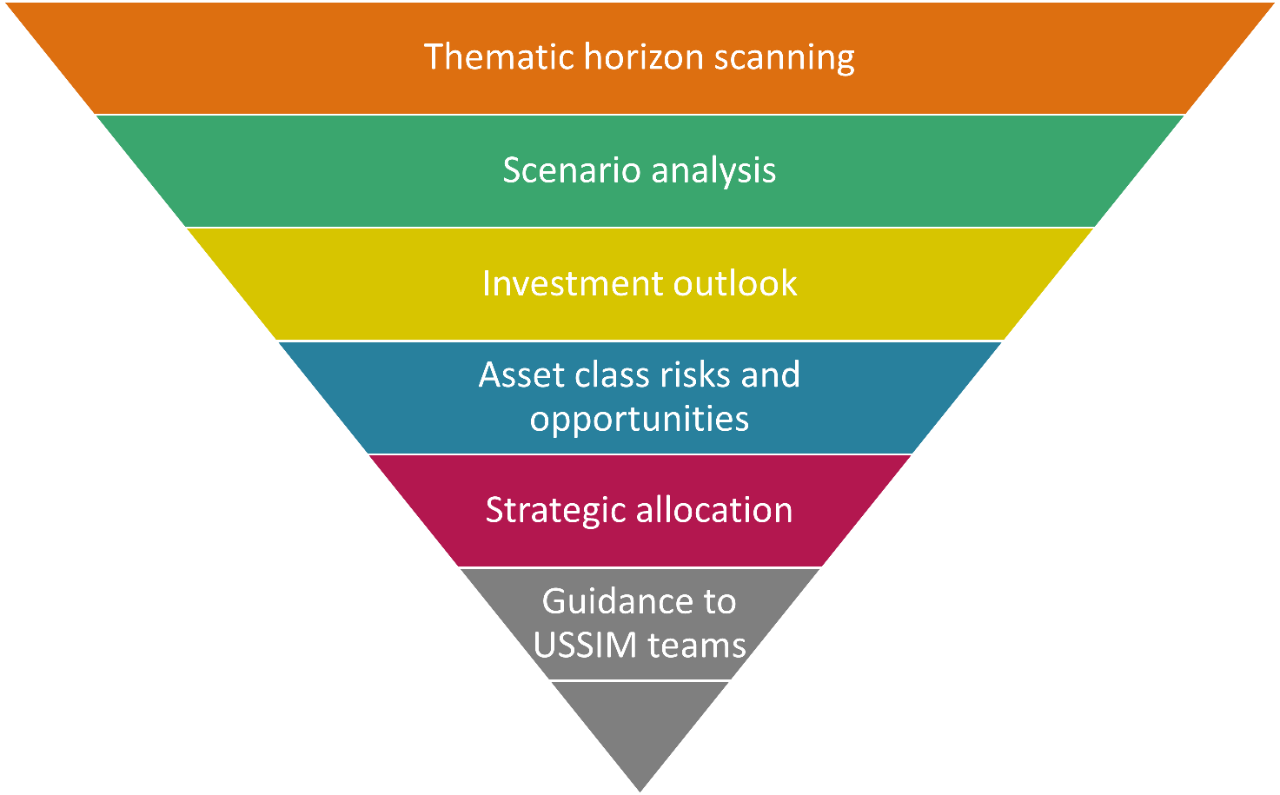

A. Step one is building the narrative scenarios using the 2x2 matrix I mentioned earlier.

Step two is establishing ranges for key variables – economic variables, financial market variables – across the scenarios.

Step three is using the narratives and the quantification to develop an investment outlook. Trying to explain, on the basis of scenarios and their implications, what kind of world we might see and what are the financial implications over the next five to ten years.

Step four is defining asset preferences based on the investment outlook:

- What asset classes will provide opportunities?

- What asset classes are more at risk?

- What are the implications for macro variables such as GDP and inflation?

- What are the implications for interest rates?

- Will risk premiums compress or widen?

All of this helps us define investment preferences.

Step five is embedding our asset preferences into our portfolio construction process to potentially reduce the exposure to the assets that were most at risk. We do a quality assessment, and it has a mix of quantitative and qualitative aspects.

Step six is providing guidance to portfolio managers on risks and opportunities beyond what can be embedded at the high-level strategic asset allocation. There are wider considerations in the scenarios – implications for specific sectors, specific regions – that it’s difficult to embed into a high-level strategic asset allocation.

Q. How do you put this into practice, practically speaking?

A. I think the first part is that you need to embrace a new approach, a new philosophy to strategic asset allocation. In a traditional approach, you are putting too much faith in a model where there is so much uncertainty. There is too much uncertainty around risk and risk–return parameters. You need a wider set of criteria. That’s the quality assessment.

There is a governance aspect to go along with this, because it is complex. It will take education of executive and non-executive bodies to embrace a very different philosophy and to think differently about asset allocation. If you have a governance model where you need a non-executive body to approve a strategic asset allocation, it is probably harder to use a more unconventional approach that has both qualitative and quantitative elements to it. We’ve been more able to tackle this because we have a framework in which the strategic asset allocation is delegated to the fiduciary manager. It is easier for us to use this approach.

You also need two-way dialogue with the portfolio manager across all asset classes. As you build an investment outlook, a discussion is needed on the macro implications as well as the implications for private markets, for fixed income assets, for equities. You also need to understand what portfolio managers are seeing on the ground to formulate a richer outlook that really captures some of those specific dynamics – for example, how the tech industry might behave in a particular scenario, what the implication of the net zero transition is for the energy sector. So having a two-way dialogue with asset class experts is very important.

Q. What would be your top tips for other pension schemes on using climate scenarios and embracing the approach that you’ve used?

A. First, don’t use off-the-shelf climate scenarios that are available and take the output at face value, which is what many funds are doing.

Second, focus on short-term horizons. Don’t try to put numbers on the expected return input to 2050, I think it’s just impossible. And if you do it, it just gives you a false sense of security that you understand what would happen in different scenarios.

So focus on short-term horizons and then try to understand the detail. Start with the narrative and then try to build the model afterwards.

Q. What are the next steps for USS?

A. We are reviewing the asset allocation of the defined benefit fund over the first half of 2024, and we want to really embed all of this into our asset allocation review.

The second milestone is to use this for Task Force on Climate-related Financial Disclosures (TCFD) reporting purposes as well. In 2025 we will refresh our scenario analysis for TCFD reporting, so we will use this new framework.

To find out more about USS’s new climate scenarios, download the No Time to Lose report, developed with the University of Exeter. You can read more about USS’s net zero ambition and download its TCFD report from the USS website.