Microsoft: Strategic Planning, Budgeting and Forecasting

Implementing an organization wide carbon fee model

DEVELOP GUIDELINES FOR OPEX AND CAPEX BUDGETING PROCESSES THAT INCLUDE SHORT AND LONG-TERM SUSTAINABILITY FACTORS

WHAT?

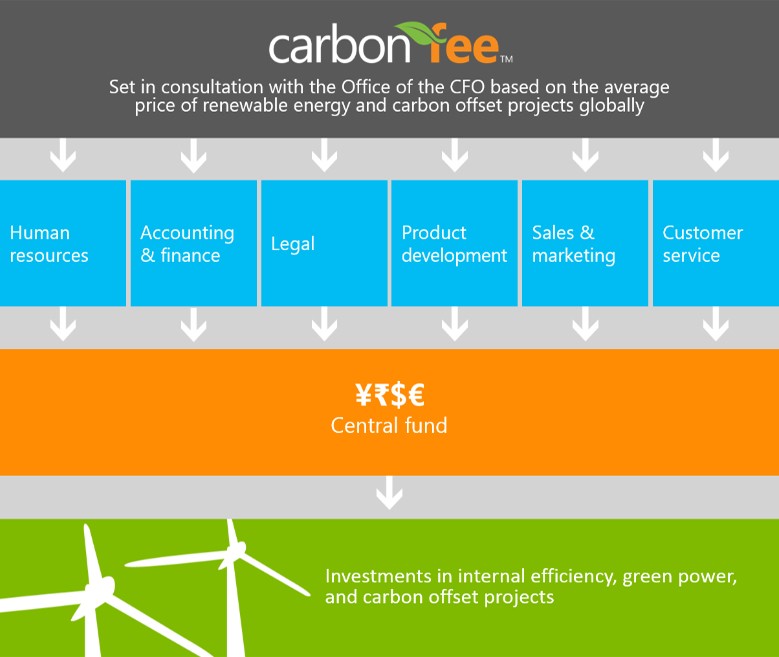

The carbon fee model that we implemented at Microsoft is a financial model that puts an incremental fee on the carbon emissions associated with our company’s operations. There are three primary components to our carbon fee model:

1. Organizational carbon reduction policy

2. Price on carbon

3. Carbon fee fund investment strategy

The price on carbon is determined by the total cost of the carbon fee fund investment strategy, which is set to meet the organizational carbon reduction policy objectives.

A carbon fee internalizes the external cost of carbon pollution into the financial structure of an organization. The associated fee is charged to those groups responsible for the resource consumption. There is no “grandfathering” (that is, a pre specified level of “free” emissions) as you might get with a cap and trade scheme.

Business groups face an immediate cost for every unit of carbon they produce. In other words, the carbon fee makes environmental impact a line item in the business group managers’ budgets across our organization based on the levels of resource consumption associated with generating carbon emissions.

By doing so, the fee helps educate the business groups on carbon emissions and elevate efficiency and innovation within our business.

By using a model in which groups are charged a fee based on their actual total usage (rather than putting a cap on usage or applying the fee to usage exceeding a predetermined level), we keep the model simple to administer and make the cost of emissions overt.

The fees that we collect through the carbon fee model go into a central fund used to subsidize investments that enable Microsoft to reduce emissions and be net carbon neutral.

WHY?

The three primary benefits supporting the decision to implement an internal carbon fee were the opportunity

to drive efficiency, demonstrate responsibility and show leadership.

1. Efficiency

A carbon fee can help drive behaviour change to increase efficiency and reduce an organization’s costs and carbon footprint. Quantifying carbon provides a standard measure, or a “level playing field”, across otherwise disparate groups to drive operational excellence.

2. Responsibility

The carbon fee model drives responsible business decisions that help mitigate potential risks associated with an organization’s environmental footprint. For Microsoft, the fee helps us address risks related to the rising costs of energy.

3. Leadership

While we believe we have a responsibility to minimize our company’s impact on the environment, we also have an opportunity to contribute to the greater good. A carbon fee model helps provide leadership in mitigating climate change, and (with the subsequent investment of the carbon fee funds) demonstrates how environmental considerations can be integrated into financial frameworks to evolve how carbon markets function. The model can ultimately support the development of a low carbon economy, jobs, education, healthcare, and address other societal challenges.

Benefits of the carbon free model to drive culture change

“A carbon fee model is an excellent way to provide both the financial framework and the formal discipline to drive efficiency projects. By applying a financial cost to the carbon impact of operational practices, it provides justification to prioritize efficiency – and therefore cost reductions – across the organization.”

Lee Mills, Senior Finance Manager, Microsoft Corporation

HOW?

Step 1: Calculate your carbon impact

• A foundational building block of a carbon emissions inventory is the development and on going maintenance of an inventory management plan (IMP), the purpose of which is to institutionalize a process for collecting, calculating, and maintaining carbon data.

• Technology plays a vital role in improving visibility into emission levels. Access to up to date data makes it easier to integrate environmental footprint management into the business. It also provides greater transparency to the executives and business leaders responsible for making business decisions.

Step 2: Establish a carbon reduction policy and develop an investment strategy

• The success of your model will depend on gaining the cooperation and buy in of key stakeholders. You will need to have the right people engaged to form a carbon reduction policy with visibility across the organization. At a minimum, the model will need the approval and participation of the finance officer of the organization.

• A carbon reduction policy outlines what commitment the organization is making to reduce carbon (such as pledging carbon neutrality). Carbon reduction targets help ensure that the design and administration of your carbon fee align with organizational goals.

• By defining your carbon fee emissions boundary in alignment with existing organizational boundaries or groups, you will help simplify administration of the fee and minimize resistance from internal audiences.

• Your carbon fee fund investment strategy will form the basis for your environmental initiatives portfolio. Your strategy will guide selection decisions by prioritizing criteria that will have an impact on the cost of your investments and therefore on your internal carbon price.

Step 3: Determine your internal carbon price

• In simple terms, you can calculate your carbon price by dividing the total cost of your environmental initiatives portfolio by the emissions within your carbon fee emissions boundary. Alternatively, you could base the price on existing or future traded values, or an estimate of the social cost of carbon.

• By allocating the carbon fee to the groups that consume the resources (and are therefore responsible for the emissions), you can help drive education, awareness, and accountability.

Step 4: Gain approval and establish governance and feedback loops

• The key to gaining the approval of leadership is to have the support of key stakeholders from the parts of the organization where the carbon fee will have the most impact.

• A cross organizational committee chartered with governance across the organization can help ensure that you maximize impact over time.

Step 5: Administer the fee, communicate results, and evolve to increase impact

• When you allocate the fee, you will need to determine the appropriate cycle to charge the organizational divisions for the projected emissions. For maximum transparency, include the carbon fee charge as an extra line item on each group and include the projected amount in the budget targeting process.

• Having a monthly or quarterly status update to true up actual emissions and costs with the projections being used as the basis for the carbon fee charges provides an opportunity to make calibrations where necessary.

• By communicating your progress with the carbon fee and investments internally, you can make sure your stakeholders know that the money they are putting in is having an impact.

• Reporting on your emissions performance externally introduces additional scrutiny to keep you committed.

• You now have an opportunity to refine and evolve your approach for maximum value for your organization.