First State Investments: Using a beliefs survey

This practical example has been taken from the A4S Essential Guide to Fiannce Culture.

What?

A decade of experience in responsible investment has taught us that individuals’ and the wider industry’s views on environmental, social and governance (ESG) issues are constantly evolving. In response to this challenge, in 2017, we commenced a project with the support of Willis Towers Watson’s Thinking Ahead Institute to establish the investment beliefs, across our entire business, relating to ESG integration, climate change and sustainability.

The analysis revealed how beliefs vary among different groups within the business, from the leadership team to individual investment and operational teams, as well as across our different regions. This rich source of information has provided the basis for building a draft set of investment beliefs for the business. This will require internal consultations and workshops to establish and then define an agreed set of statements that will both integrate sustainability into our corporate culture and align within the organization

Why?

The main benefit is that we now understand the different views of our colleagues and can incorporate these into

our strategies and change programmes in the future. The research has helped us to investigate whether there are any regional biases across the organization by, for example, comparing views of our colleagues in Europe or Asia with those in Australia and the USA.

The survey is also now used in our recruitment processes to help us understand whether new people will share the beliefs of the teams they are joining.

How?

In its first phase, this project involved a business-wide survey testing the extent of individual beliefs on issues such as:

- The materiality of ESG factors

- The extent to which ESG factors are mispriced and can therefore contribute to long-term investment performance, and

- The wider social purpose of sustainability, ESG and stewardship in investment management.

Helpfully, we were able to assess and benchmark our own beliefs against those of a peer group of managers and asset owners within the Willis Towers Watson client base who have completed a similar exercise.

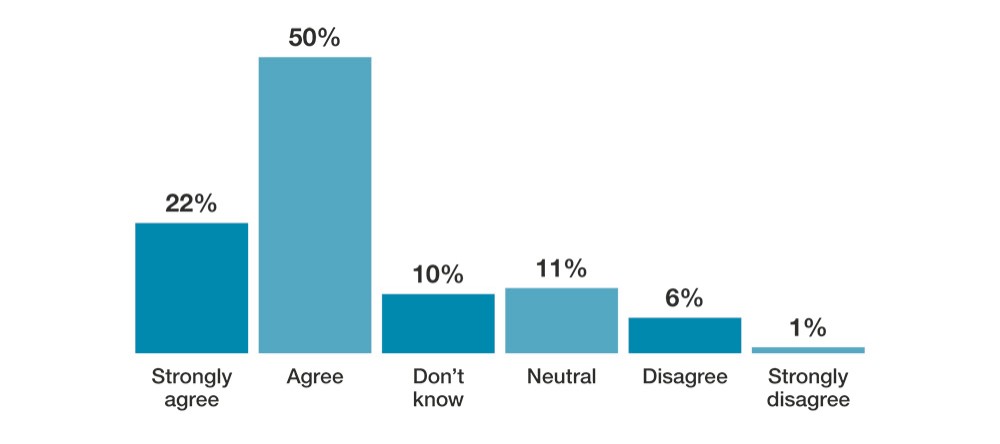

Statement

“I believe that companies can gain significant competitive advantage through their strategic response to climate change and/or natural resource scarcity/environmental degradation.”