Q&A with Bob Eccles

Robert G. Eccles, is Visiting Professor of Management Practice at Saïd Business School, University of Oxford

What role has purpose and a purpose-driven mindset played in responses to the pandemic by the business, finance and accounting community?

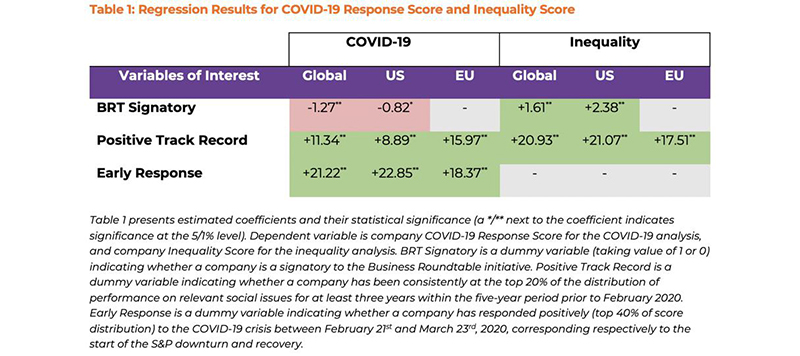

It is hard to assess this because it’s difficult to separate the now ubiquitous purpose “talk” from purpose “walk.” The “COVID-19 and Inequality: A Test of Corporate Purpose (TCP) initiative attempted to assess that. For example, it found that the signatories to the Business Roundtable’s “Statement of the Purpose of a Corporation” performed a bit worse than a global set of companies, although they did perform a bit better on inequality. The companies that performed the best in dealing with COVID-19 were those that responded quickly to the pandemic and that had superior performance on sustainability in general for the past five years. Whether companies are using “purpose” language or not is less important than their actions.

How can purpose play a role in a sustainable recovery?

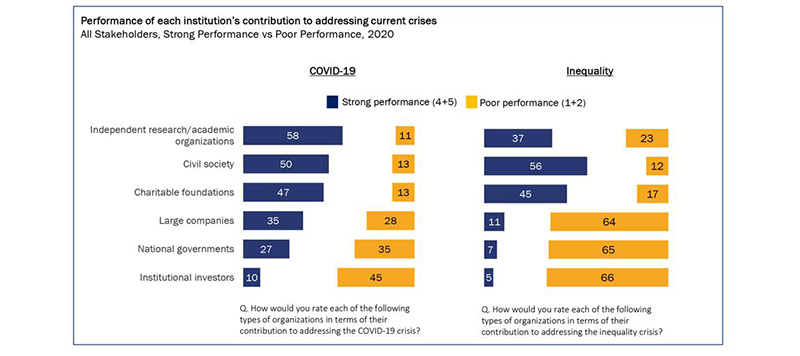

It can only do so if it’s authentic and this gets to the fundamental question of the role of the corporation in society. A global survey for the TCP found that 92 percent agreed that the corporation should meet the needs of other stakeholders than simply shareholders. It also found that companies and institutional investors were rated poorly. In fact, institutional investors ranked last and by a wide margin. Only 10 percent of respondents rated them as performing well (vs. 35 percent for companies) and 45 percent rated them as performing poorly (vs. 28 percent for companies). This suggests that the investment community needs to do more to support companies who are genuinely committed to purpose. It is hard for a company to take a long-term, purpose-driven approach when its investors are pressuring it to deliver quarterly earnings.

What actions will support the adoption of purposeful approaches to business and finance?

In an HBR piece “3 Ways to Put Your Corporate Purpose into Action” Leo Strine, Tim Youmans, and I suggest the following steps. The first is a “Statement of Purpose” signed by every member of the board of directors. A true commitment to purpose must start with the board of directors. Very few companies have done this. The only U.S. company to have done so is Philip Morris International, Inc. (to whom I’m an advisor). Their purpose is to create a “Smoke-Free” future. Next, the company needs to issue an integrated report that shows how it is accomplishing its purpose. PMI has done this as well, including targets for 2025 for their Business Transformation Key Performance Indicators. The Swedish private equity firm EQT has also published a “Statement of Purpose” in its 2019 Annual Report. Finally, if a company is deeply committed to purpose it should become a public benefit corporation. Further guidance on how to put purpose into practice can be found in this report “Enacting Purpose Within the Modern Corporation: A Framework for Boards of Directors” by the Oxford-led “Enacting Purpose Initiative” Co-Chaired by Professor Colin Mayer, Rupert Younger, and me. The report explains how purpose is different from but related to vision, mission, and values. It also articulates the SCORE Framework developed by Younger: Simplify, Connect, Own, Reward, and Exemplify. This framework is proving quite useful to boards and senior executives to ensure that their company is enacting purpose in an authentic way.