Supporting the TNFD Recommendations

What finance teams need to know about the Taskforce on Nature-related Financial Disclosures

A thriving natural world is essential for our health, livelihoods and the resilience of our supply chains and economies. While some sectors are particularly dependent on nature, all companies rely on some ecosystem services, such as fresh water and clean air. Nature is also essential to the fight against catastrophic climate breakdown, helping to absorb the greenhouse gas emissions that we put into the atmosphere and protecting us from the physical impacts of a warming climate.

Yet nature is being destroyed at a faster pace than any time in human history. According to the World Economic Forum, economic value generation of US$44 trillion is highly or moderately dependent on nature – half of the world’s economic output.

Many organizations don’t understand how nature and biodiversity loss affect their immediate financial performance and struggle to assess the possible longer-term financial risks from the impacts they have on the natural world. The Taskforce for Nature-related Financial Disclosures (TNFD) aims to help bridge this gap.

Julie Brown, Chief Financial Officer at GSK, A4S CFO Leadership Network (Europe) Co-Chair: “Protecting nature makes our business more resilient [...] That’s why we’re proud to be a member of the Taskforce on Nature-related Financial Disclosures. We have started to implement the TNFD methodology to better understand our nature-related risks and opportunities and are committed to publish our first TNFD disclosures from 2026, based on 2025 data.”

What is the TNFD?

The TNFD is a global, market-led, science-based initiative established in 2021. It seeks to:

Develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks and opportunities.

Balance the need for transparency and comparability for investors with simplicity and flexibility for report preparers.

Support a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes.

Given the link to financial performance, finance teams will have a key role to play in delivering the TNFD recommendations.

How will the TNFD recommendations affect my organization?

Many organizations will already be making some nature-related disclosures – using the Global Reporting Initiative (GRI), for example. These disclosures are likely to focus on the impacts of the organization on nature, and cover areas such as the significant direct/indirect impacts on biodiversity as measured by the species affected, or total water withdrawal from all areas with water stress. Further, for organizations covered by the EU’s Corporate Sustainability Reporting Directive (CSRD), reporting on nature-related impacts and dependencies will be mandatory. The TNFD framework, though, calls for broader disclosures that link to financial performance, following a similar approach to that adopted by the Task Force on Climate-related Financial Disclosures (TCFD).

With policy makers, regulators, investors and businesses increasingly recognizing the risks posed by the collapse in ecosystems and biodiversity, as well as the opportunities from investing in nature, there is a significant focus on closing the disclosure gap. As a result, we expect that nature-related disclosures will soon become a business norm. This is driven by:

External drivers:

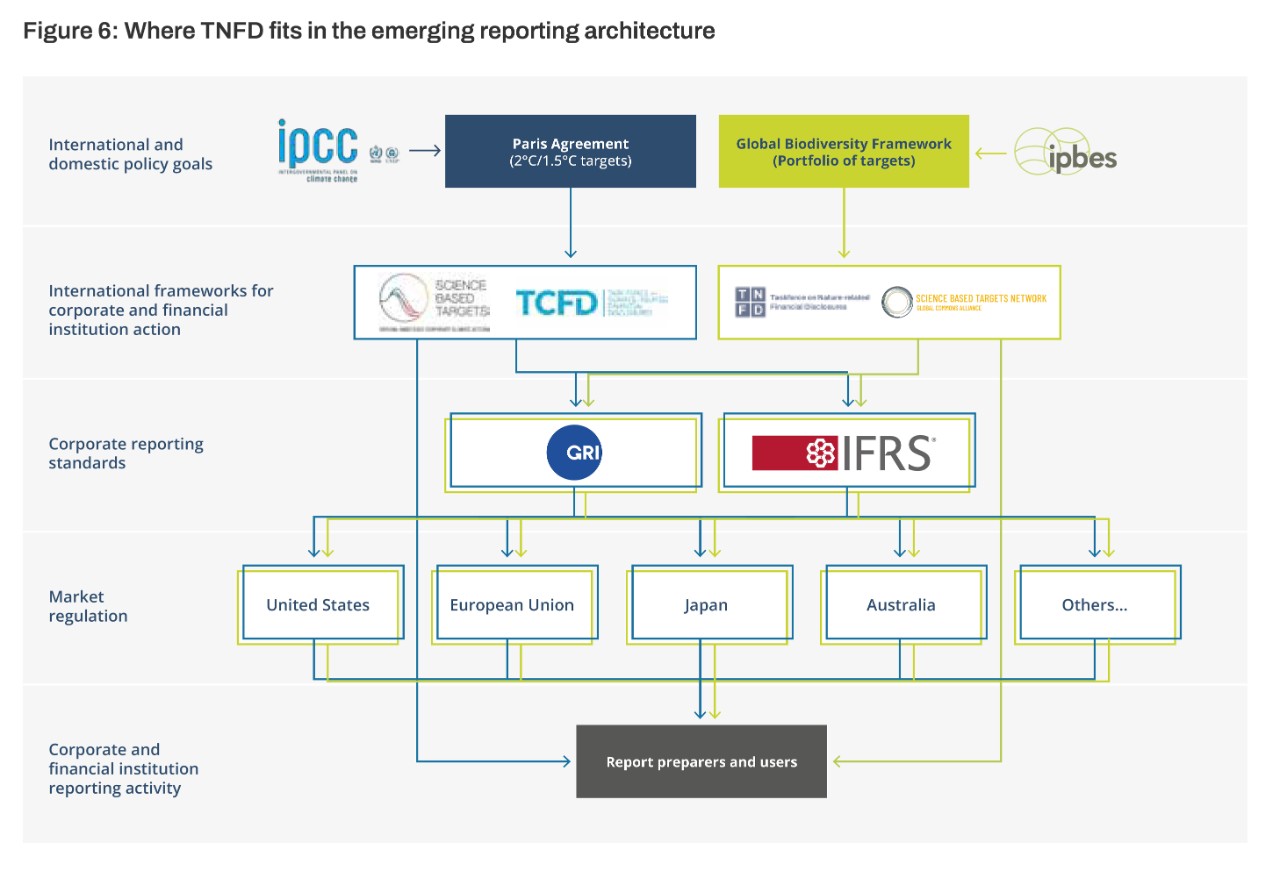

Regulation – while the TNFD recommendations are currently voluntary, this framework for nature-related disclosures has strong government backing and, given the broad consultation process followed in its development and its alignment with the TCFD recommendations, is likely to inform regulatory adoption. The TCFD framework now informs mandatory climate regulations in a growing number of jurisdictions, and the TNFD is set to follow a similar path. In particular, at COP15, governments agreed to ensure that all large companies assess and disclose their risks, impacts and dependencies on nature by 2030 as part of the Global Biodiversity Framework (GBF).

Investors – the markets are calling for improved disclosures so that investors can make informed and robust capital allocation or lending decisions, with clarity, confidence and trust in the data related to nature-related risks. This means that following the TNFD recommendations can help organizations maintain access to capital. Further, some investors are linking engagement and voting actions to companies’ adoption of the TNFD recommendations.

Internal drivers:

Risk management – organizations are likely to carry nature-related risks that are not currently quantified, adequately managed or disclosed. Following the TNFD recommendations will lead to more informed strategic planning and better risk management.

Value creation – improved understanding of and information on nature will help build sustainable value and resilience in operations and supply chains and could support talent attraction and retention, as well as helping the organization to deliver on its climate commitments.

Organizations therefore need to prepare now, ensuring they have the right skillsets within their finance teams.

What are the TNFD recommendations?

The TNFD framework consists of three elements:

- A summary of concepts and definitions

- Guidance for corporates and financial institutions on the process of assessing nature-related issues and incorporating them into strategy and risk management

- Recommended disclosures

1. Concepts and definitions

The TNFD definition of nature includes the atmosphere, and therefore the climate system, alongside land, ocean and freshwater realms of nature.

2. Process

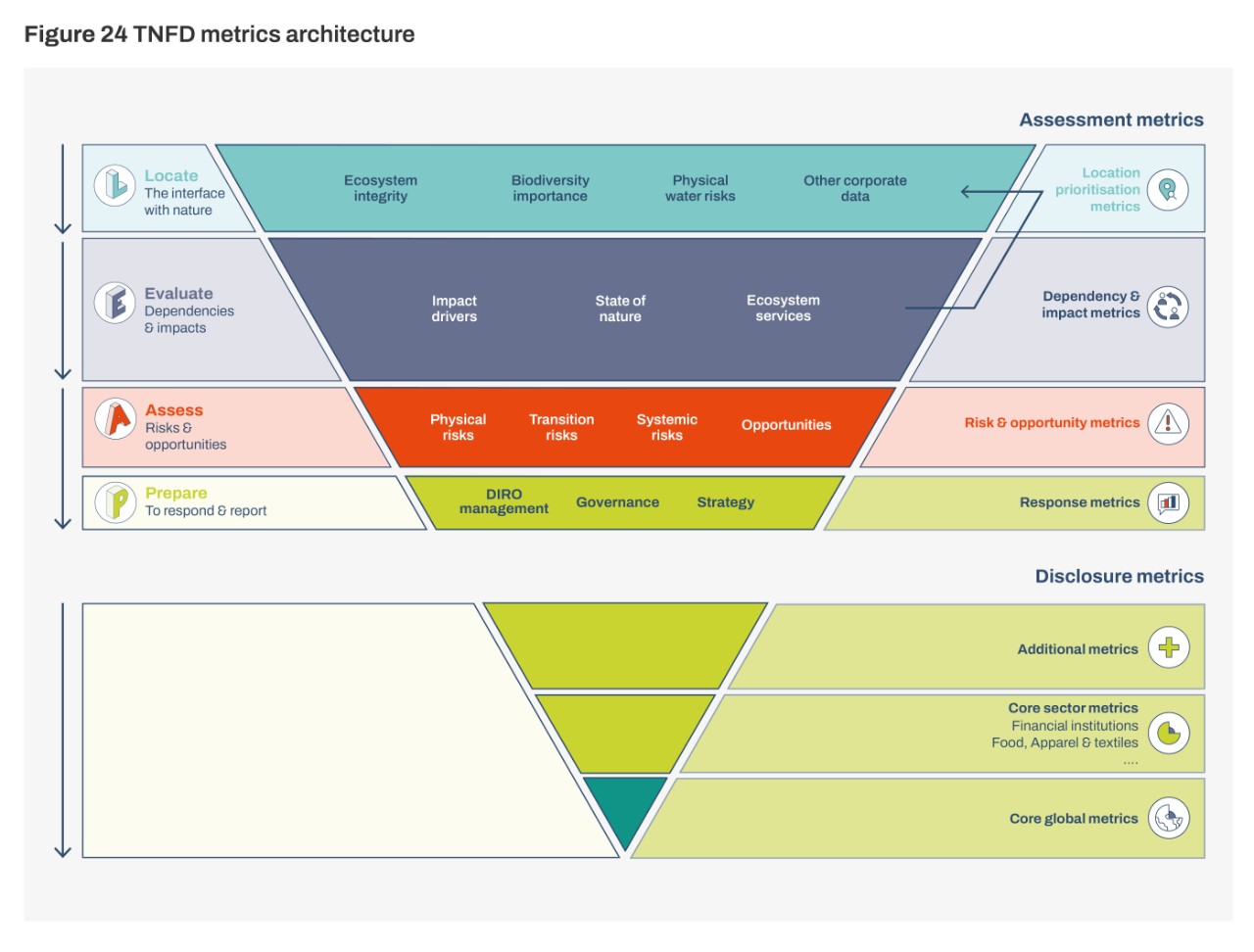

TNFD guides users on how to identify and quantify disclosures, using the LEAP approach it has developed:

Locate an organization's interface with nature

Evaluate dependencies and impacts

Assess risks and opportunities

Prepare to respond to nature-related risks and opportunities

The material issues arising from this process should then be disclosed.

3. Disclosures

To maximize the speed and ease of take-up of TNFD, the structure, language and approach of the disclosures closely align with the TCFD recommendations.

The TNFD framework uses the same four pillars as TCFD: governance, strategy, risk management, and metrics and targets. There are also cross-cutting general disclosure requirements. These include a description of the organization’s materiality processes and how location has been considered in the assessment – a key element given the location-specific element of the majority of nature-related issues.

TNFD has sought to identify metrics that are science-based but are also practical for preparers and can be independently assured at a reasonable cost. To provide maximum user flexibility, there are two main categories of core disclosure metrics:

Core global metrics are relevant to organizations across sectors and are reflected in global policy priorities.

Core sector metrics are sector-specific, enabling capital providers to make comparable assessments of businesses within a sector. These are currently open for consultation.

TNFD also recommends additional disclosure metrics, which an organization may choose to use where these metrics are particularly relevant to their business model and nature-related issues.

Disclosures should then be broken down, where relevant, into direct operations, upstream and downstream value chains.

TNFD also provides a range of supporting guidance, which includes guidance on sectors, biomes, target setting, scenario analysis and transition plans, along with case studies.

How does TNFD relate to wider disclosure frameworks?

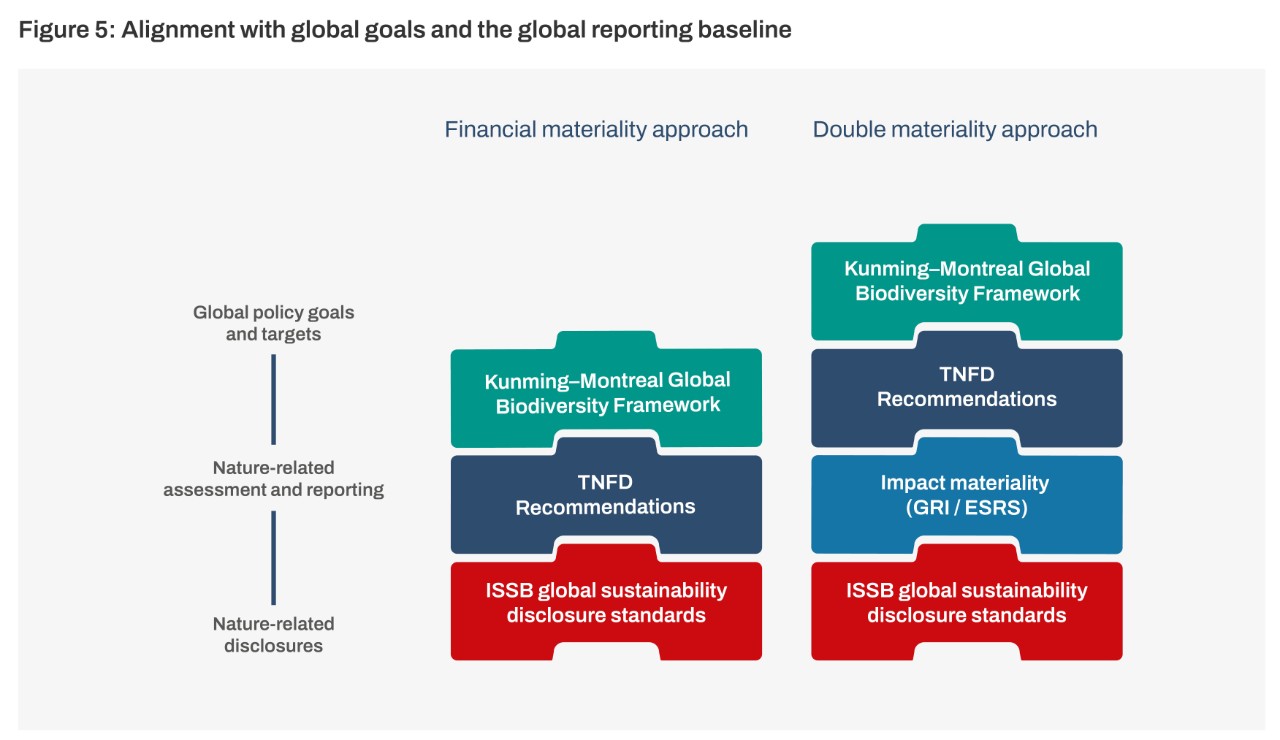

The TNFD framework draws from, and feeds into, pre-existing frameworks, including the new standards from the IFRS’s International Sustainability Standards Board (ISSB) and the GRI Standards. By using pre-existing tools, definitions and metrics, TNFD aims to avoid duplication, and to support the creation of a coherent global framework for nature-related risk management and disclosure.

How has TNFD approached the issue of materiality?

The TNFD’s recommendations have been designed to accommodate the different materiality preferences and requirements of a range of report preparers across jurisdictions. The framework recommends that organizations apply the ISSB’s approach to identifying information that is material for users of general purpose financial reports as a baseline, ie financial or single materiality. Those who choose to or need to (eg due to local requirements) may apply an impact or double materiality approach to identify information in addition to the ISSB’s baseline.

They note that those seeking to align with Target 15 of the UN’s Global Biodiversity Framework – which requires large organizations regularly to monitor, assess, and transparently disclose their risks, dependencies and impacts on biodiversity along their operations, supply and value chains and portfolios – will want to consider the application of an impact materiality lens to identify information that is incremental to the global baseline.

What is the role of finance teams?

As the TNFD recommendations are set to shape nature-related disclosures and reporting standards, in particular with the focus on the financial implications of nature loss on business, CFOs and their teams can play an important role in readying their organization for adoption. Leveraging their skills and insights, finance teams can:

Promote nature-related disclosures. As custodians of value that understand the business case for change, finance can inform, actively support and challenge key internal and external stakeholders to improve nature-related financial disclosures.

Build into management information and reporting to ensure key management and board members have the necessary information and knowledge to assess the financial impact of the organization’s relationship with nature, drawing on in-house resources and external sources as necessary.

Consider how to integrate into financial processes including budgeting, capital allocation, investment, measurement, reporting and auditing to reflect nature-related dependencies, impacts, risks and opportunities.

Help to ensure that any short-, medium- and long-term targets are underpinned by reliable data and facilitate efficient data collection and verification processes.

Assist with scenario analysis that reflects potential outcomes in the face of complex uncertainties.

Engage with data users including investors to understand how they will use the disclosures and what information will enable them to respond effectively to nature-related risks and opportunities.

What steps should I take now?

Time is of the essence. Scientific consensus tells us we need to halt and reverse nature loss by 2030 and move to a nature positive economy by 2050.

Nature and climate are closely interlinked, and it is important for both organizations and investors to consider impacts and dependencies in tandem. Leading organizations are already planning to produce integrated disclosures. Nature must not be left as an afterthought. View the A4S top tips to help you get started on TNFD implementation.

Use the A4S maturity map to help you assess how mature your nature-related disclosures are.